Building a financial cushion for your business is never easy. Experts say that businesses should have anywhere from six to nine months worth of income safely stored away in the bank. If you’re a business grossing $250,000 per month, the mere thought of saving over $1.5 million dollars in a savings account will either have you collapsing from fits of laughter or from the paralyzing panic that has just set in. What may be a nice well-advised idea in theory can easily be tossed right out the window when you’re just barely making payroll each month. So how is a small business owner to even begin a prudent savings program for long-term success?

Realizing that your business needs a savings plan is the first step toward better management. The reasons for growing a financial nest egg are strong. Building savings allows you to plan for future growth in your business and have ready the investment capital necessary to launch those plans. Having a source of back-up income can often carry a business through a rough time.

When market fluctuations, such as the dramatic increase in gasoline and oil prices, start to affect your business, you may need to dip into your savings to keep operations running smoothly until the difficulties pass. Savings can also support seasonal businesses with the ability to purchase inventory and cover payroll until the flush of new cash arrives. Try to remember that you didn’t build your business overnight and you cannot build a savings account instantly either.

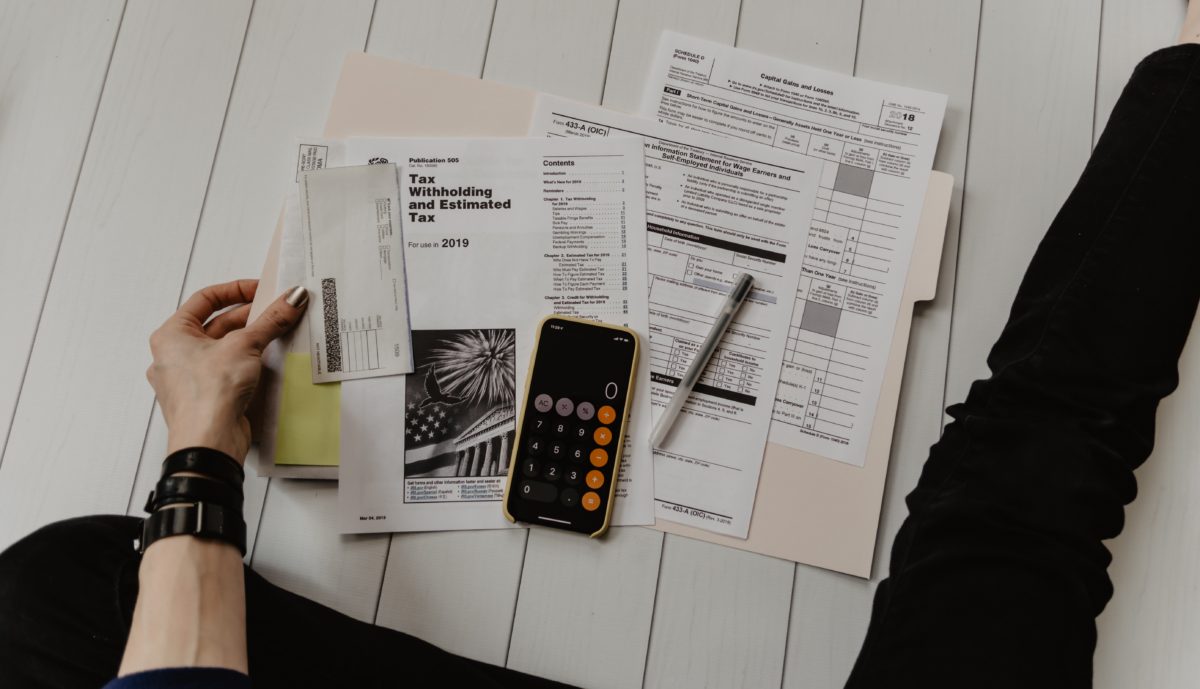

Review your books monthly and see where you can trim expenses and reroute the savings to a separate account. This will also help to keep you on track with cash flow and other financial issues. While it can be quite alarming to see your cash flowing outward with seemingly no end in sight, it’s better to see it happening and put corrective measures into place, rather than discovering your losses five or six months too late.

At Peavy and Associates PC our mission is to assist you with all your tax preparations, payroll and accounting needs. We provide our clients with professional, personalized accounting services and guidance in a wide range of financial and business needs. Give us a call today and discover why our clients return to Peavy and Associates, PC year after year!